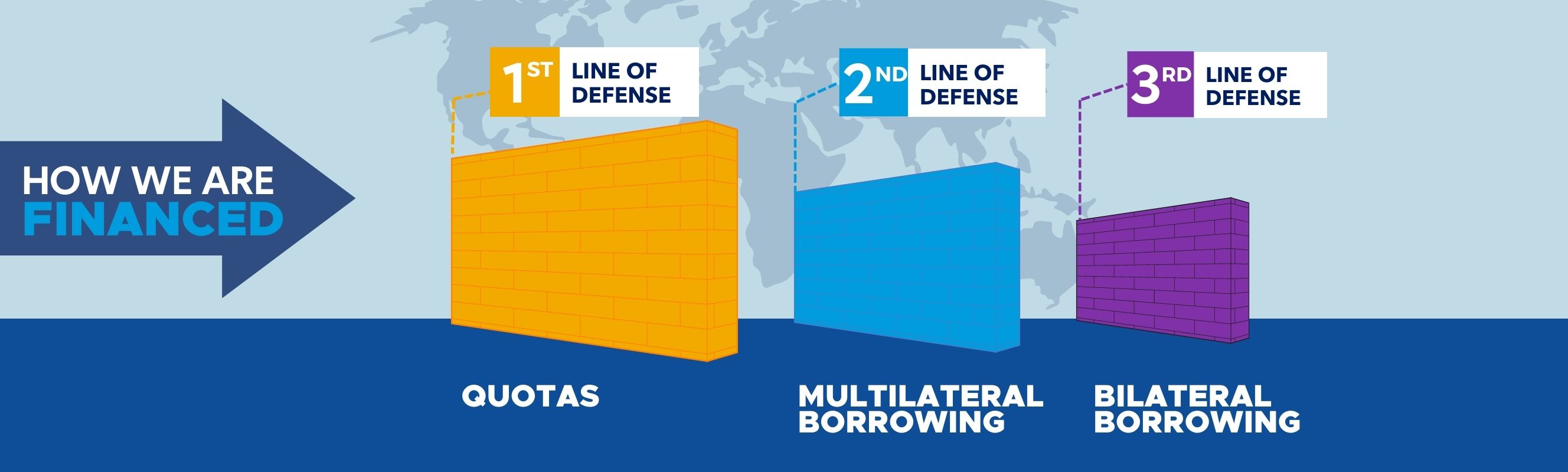

IMF funds come from three sources: member quotas, multilateral and bilateral borrowing agreements.

Member quotas : Member quotas are the primary source of IMF funding. A member country’s quota reflects its size and position in the world economy. The IMF regularly reviews quotas to assess their adequacy overall and their distribution among members.

The IMF's resources mainly come from the money that countries pay as their capital subscription (quotas) when they become members. Each member of the IMF is assigned a quota, based broadly on its relative position in the world economy. Countries can then borrow from this pool when they fall into financial difficulty.

New arrangements to borrow : New Arrangements to Borrow (NAB) between the IMF and a group of members and institutions are the main backstop for quotas. The size of the NAB was doubled in 2021. The NAB currently contributes SDR 364 billion, or $489 billion, to total IMF resources.

The New Arrangements to Borrow (NAB) constitutes a second line of defense. Through the NAB, certain member countries and institutions stand ready to lend additional resources to address challenges to the international monetary system.

Bilateral borrowing agreements : Member countries also have committed resources through bilateral borrowing agreements (BBAs). In 2020, the IMF Executive Board approved a new round of BBAs, : which currently contribute SDR 141 billion, or $189 billion, to total IMF resources.

Bilateral Borrowing Agreements serve as a third line of defense after quotas and the NAB. Since the onset of the global financial crisis, the IMF has entered into several rounds of bilateral borrowing agreements (BBAs) to meet its members’ financing needs.

The IMF’s current total resources of about SDR 982 billion translate into a capacity for lending of about SDR 695 billion (around US$932 billion), as at mid-December 2023.

Comments

Write Comment