When a country joins the IMF, it has to pay an amount as a subscription quota to the IMF. This amount has to be paid in Domestic currency (75%) and other freely usable currencies or in SDR (remaining 25%). (Click here to fund to know how IMF is financed).

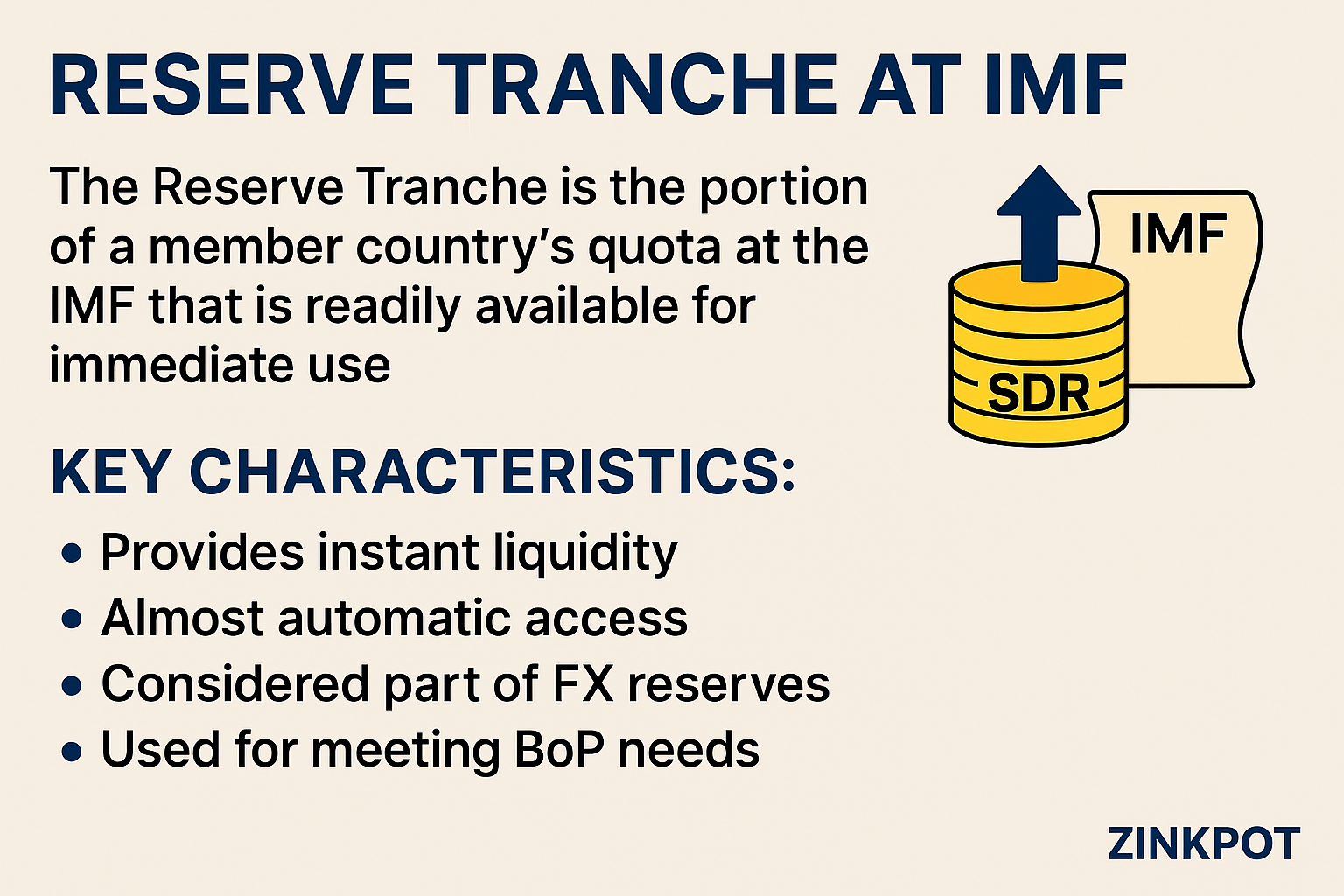

The Reserve Tranche is the portion of a member country's quota at the International Monetary Fund (IMF) that is readily available for immediate use without any charges to address balance of payment needs. The Reserve Tranche Position (RTP) is the difference between a member’s quota at the IMF and the IMF’s holdings of that member’s currency.

It therefore represents the portion of a country’s IMF subscription which is 25% as mentioned above and is usually paid in foreign currency or SDRs. Reserve Tranche = Quota − IMF Holdings of Member’s Currency

For Example

So India can withdraw SDR 3.5 billion without IMF program conditions.

Comments

Write Comment