What is the purpose of the SDR?

The IMF created the SDR as a supplementary international reserve asset in 1969, when currencies were tied to the price of gold and the US dollar was the leading international reserve asset. The IMF defined the SDR as equivalent to that amount of gold that was equivalent to one US dollar.

When fixed exchange rates ended in 1973, the IMF redefined the SDR as equivalent to the value of a basket of world currencies.

The allocation of SDRs by IMF to its member countries is done as per the quota system prevalent in IMF mechanism. When a country joins the IMF, it is assigned an initial quota in the same range as the quotas of existing members.

This IMF quota is the weighted average of a country’s GDP, openness, economic variability and international reserves. The stronger a country’s economy, the higher quota share it has.

The allocation of SDR is also based upon the amount of contribution to the capital reserve by a country to the IMF at the time of its initiation of the membership. For example, as United States have contributed the most to the total reserve of SDR, it holds the maximum percentage in the total allocation i.e. 17.46%. India’s current quota in IMF is 2.44%.

In order to determine the value of 1 SDR, IMF uses a basket of five currencies which are chosen on the basis of the amount of exports of the country and the ease of convertibility of the currency of the respective country.

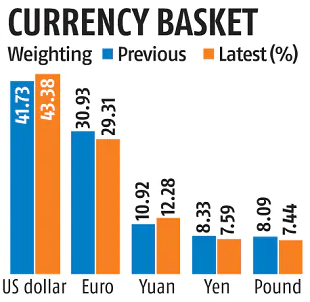

Presently, the SDR basket of currencies include US Dollar, Euro, Japanese Yen, Pound Sterling and Yuan (Chinese Renminbi). Taking in account all of these, the cost of 1 Special Drawing Right in USD today is $1.33. click here for real time value.

The value of 1 SDR keeps on fluctuating based upon the spot exchange rates. The IMF reviews the SDR basket every five years.

The most recent allocation of SDRs was done In August 2021 of 456 billion SDR, which is the largest allocation ever. It was done to address the long-term global need for reserves and help countries cope with the impact of Covid-19 pandemic.

Only IMF and IMF members can hold SDRs and the IMF has the authority to approve other holders, such as central banks and multilateral development banks while individuals in private entities cannot hold SDRs.

SDR helps members to reduce their reliance on more expensive domestic or external debt for building reserves This is because the interest on SDR is a comparatively low as compared to other external debts.

To date, SDR 660.7 billion has been allocated, which is equal to approximately $943 billion.

Comments

Write Comment