What is a Bond price: It is the price at which an investor buys a bond.

Coupon rate: This is the periodic interest rate paid to the investors by the issuers on the bond's face value.

Face value: Also called par value, it is the price that the bond issuer pays to the investor at the time of the bond’s maturity

Bond yield: This is the total earnings realised over a given time from the investments in Bonds and is represented by a percentage.

Yield to maturity: This is the total return anticipated on a bond if it is held until its maturity.

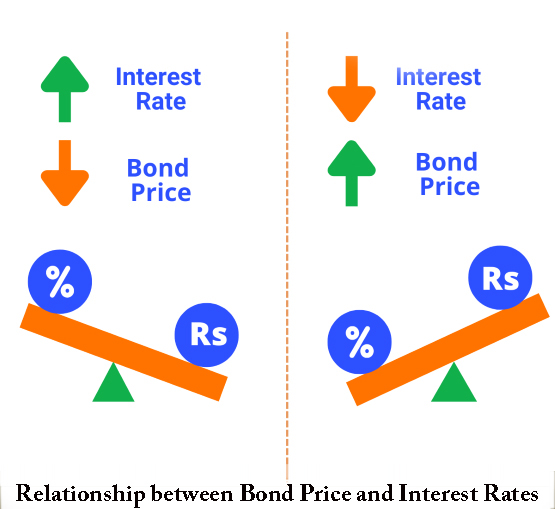

Relationship between Bond Prices and Bond Yield

The yield and bond price have an inverse relationship. When the bond price is lower than the face value, the bond yield is higher than the coupon rate. When the bond price is higher than the face value, the bond yield is lower than the coupon rate. So, the bond yield calculation depends on the price of the bond and the coupon rate of the bond.

If the bond price falls, the yield rises, and if the bond price rises, the yield falls.

So, the bond price has gone up, which causes the yield or the interest rates on the bond to decrease.

Comments

Write Comment